The global FinTech market is on the rise over the last few years especially driven by the increasing adoption of digital banking, lending, payments, and other embedded finance solutions. Investments in the sector have also rapidly increased as companies compete to enhance their digital capabilities and provide a better customer experience while meeting regulatory compliance at the same time.

The Global FinTech market is expected to reach $16.7tn by 2028, growing at a 13.9% CAGR(i) during 2021-’28, predominantly driven by a rise in digital banking and growing interest in crypto and blockchain applications.

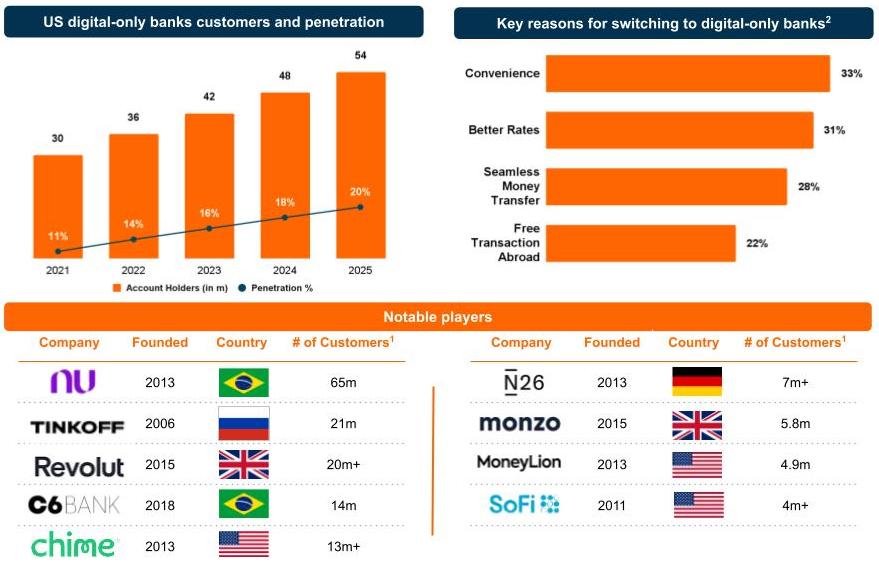

Digital-only banking platforms are disrupting the banking space

US penetration in neo-banking remains low relative to Europe and LATAM despite having a larger absolute number of users, Convenience, flexibility, and personalized experiences drive the user decisions for switching to digital-only banks.

Key Themes

- U.S. embedded finance payments expected to boom over the next 10 years: The embedded finance market in the U.S. mainly consisting of payments, insurance, consumer lending, and wealth management is expected to exceed $7tn in the next 10 years, double the combined value of the world’s top 30 banks today. The global Buy Now Pay Later (BNPL) market, a key constituent of embedded finance is expected to reach $3.9tn by 2030 (a 45.7% CAGR from 2021-’30)

- Blockchain is accelerating FinTech payment solutions: Blockchain technology is being increasingly adopted by major firms such as Microsoft, AT&T, and Twitch to enhance payments as it offers fast, secure, and low-cost international payment processing bypassing the need for intermediaries

- FinTechs are increasingly leveraging AI and ML for fraud detection, compliance, and digital transformation: Increased use of digital payment apps, cross-border transactions, and e-banking, along with a number of fraudulent cases involving data breaches, payment frauds, and identity thefts, are driving the demand for AI-based fraud management solutions. Most FinTechs including lending apps have been leveraging automated origination processes that empower businesses to secure financing with quick turnarounds, resulting in cost and time savings for businesses and lenders

- Decentralized finance applications are being increasingly harnessed by FinTechs: DeFi platforms are capable of addressing high-volume transactions and mitigating error-prone manual processes through smart contracts. Millions of new users are lending, borrowing, trading, saving, and transacting through the rapidly growing DeFi use case

By The Numbers: The Booming FinTech Industry

- The industry attracted over $48.5bn in funding for the year ending Q2, 2022, with Social Finance, Chime, and Checkout.com raising over $1.2bn, $1.1bn, and $1.0bn respectively

- After recording 79 consolidation deals in 2021 (41% increase y-o-y) with a total value of ~$70bn (68% increase y-o-y), the space remained relatively muted during H1’22 with 62% fewer deals* as compared to H1’21.

- Notable deals during H1’22 include, MoneyGram ($1.9bn), Wyre ($1.5bn), Technisys ($1.0bn), LIS Pay ($0.8bn), and Finxact ($0.7bn)

2022 and Beyond

While payments continue to be the hottest sub-segment in 2023 in terms of deal value, we expect digital banking platforms, wallets, and other embedded solutions including insurance, and consumer lending as well to attract significant investments in the coming years. M&A activity is expected to remain strong in 2023 as a result of increasing consolidation among payments firms and as the number and size of add-on transactions rise, particularly in cases with unique regulatory assets and/or where economies of scale represent significant value levers.

ComCap has also published its Fintech Innovators and Commerce Enablers Report which covers key themes, market landscape, recent transactions, and a list of the most active investors within the sector. Please find our Fintech Report here.

Copyright © 2022 ComCap LLC member, FINRA & SIPC, All rights reserved.

About ComCap

ComCap is a premier investment bank focused on M&A and capital-raising services in the digital commerce, marketing, consumer, and payments ecosystems. Founded in 2012 in San Francisco, California, ComCap works with clients globally to ensure the achievement of their strategic priorities. For more information, please visit https://comcapllc.com.