The Digital Dealer Conference & Expo took place at Tampa Convention Center in Tampa, Florida on May 1-3, 2023. Thousands of professionals from leading dealerships and from all facets of operations as well as OEMs attended the conference. Speakers delivered over 75 actionable sessions presented by industry thought leaders and subject matter experts across dealership sales and service.

Key takeaways from the Digital Dealer conference:

1. Omnichannel marketing is hot: Dealers are strongly pursuing advertising and marketing across multiple channels to engage more customers, drive more traffic, and ultimately increase business at a greater ROI. Customers that start in a digital retail channel and then visit the dealership now expect a fully integrated experience from digital to in-store. Dealers are expanding their strategies and processes to optimize at each touchpoint and move customers further down the funnel including through investments in video marketing, advertising metrics and reporting, local SEO, PPC, omnichannel strategy, audience targeting and engagement, and social media. Expect omnichannel marketing spend to remain strong as dealers compete for fewer car buyers in this rising interest rate environment.

2. Human capital management technologies are expanding: Following pandemic staff turnover, dealers are spending on softwares to assist their more novice sales staffs. Further, veteran sales processes have again been disrupted by growing omnichannel sales and marketing. Dealers are spending on offerings that allow them to build and lead a loyal team and on technologies that drive efficiency including in talent management, culture, retention, reputation, and loyalty. Expect this space to remain hot as legacy platforms seek acquisitions to fill their gaps in human capital management.

3. Repossession capacity is growing: High vehicle prices coupled with high interest rates are putting pressure on consumers, and lenders are building their capacities for current and projected repossessions. Repossession rates have returned to pre-pandemic levels, and subprime loan repossession rates are now higher than in 2019. With the repossession industry facing the same labor shortages plaguing the macroeconomy, lenders are securing as much capacity as possible to be able to quickly recoup their losses on defaulted loans. Expect this space to continue growing, particularly if the economy falls into recession.

If you want to discuss this subject further, please schedule a meeting with our Director Lawrence Pier.

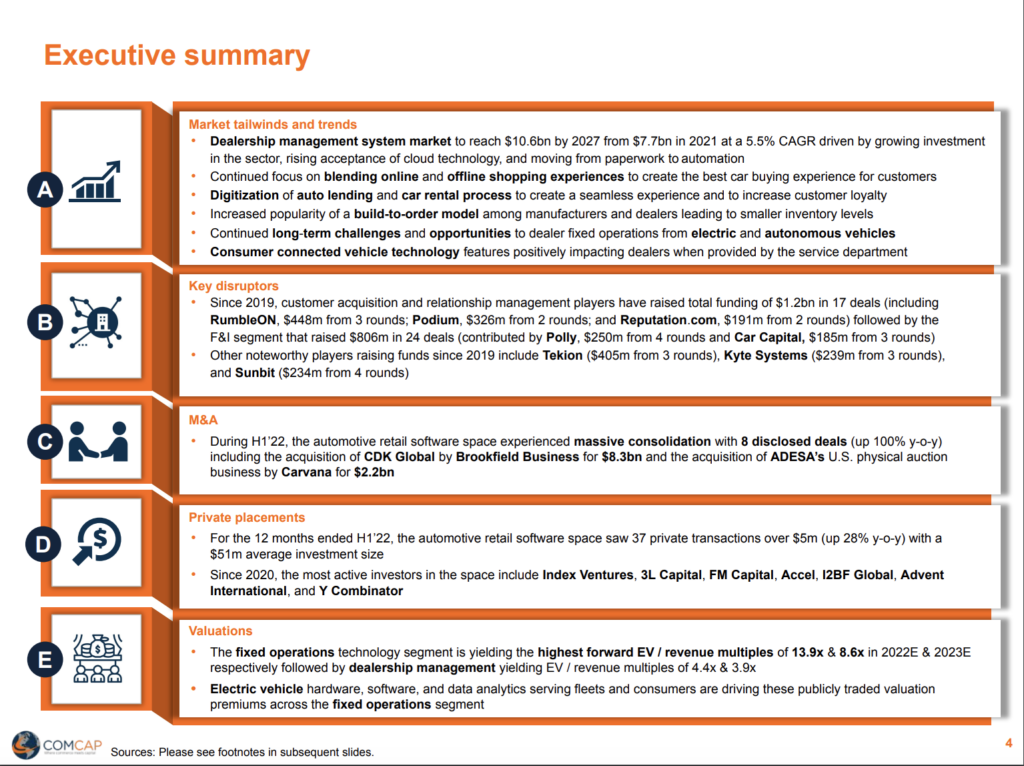

ComCap also publishes its Automotive Retail Software Market Activity Report that covers key themes, market landscape, recent transactions, and a list of the most active investors within the sector. Please find our Auto Report here.